THE AI-POWERED FUTURE OF THE FINANCIAL INDUSTRY

| AI and cloud technologies present a major opportunity for the financial services industry to modernize operations, improve decision‑making, and deliver more personalized, secure experiences. Cloud platforms provide the scalability and resilience needed to process massive volumes of financial data in real time, while AI enables automation of routine tasks, advanced analytics, fraud detection, risk modeling, and intelligent customer engagement. Together, they help financial institutions increase efficiency, respond faster to market and regulatory changes, and unlock greater value from their data. |  |

However, many organizations struggle to realize these benefits due to fragmented, poorly integrated technology environments. Siloed systems limit AI’s access to complete and trusted data, reduce the effectiveness of automation, and increase operational risk, cost, and security exposure. Without integration, compliance becomes more manual, insights remain partial, and real‑time responsiveness is difficult to achieve—preventing AI and cloud from becoming a true enterprise foundation rather than isolated tools.

ADVANCED TECHNOLOGY INVESTMENT IS CRITICAL IN FINANCIAL SERVICES

AI and cloud technologies are now core to competitiveness in financial services, enabling faster, more intelligent, secure, and resilient operations. Together, they modernize legacy environments, automate complex processes, strengthen risk and fraud management, and support more personalized customer experiences.

Yet most institutions remain early in scaling AI. McKinsey’s 2025 global AI survey finds that nearly two‑thirds of respondents have not begun scaling AI enterprise‑wide, despite widespread experimentation. The biggest constraint isn’t ambition, but integration and data readiness—making interoperability, governance, and workflow redesign the clearest path to sustainable differentiation.

|

To remain competitive, financial enterprises must move beyond isolated pilots and fragmented systems and adopt integrated, secure, enterprise platforms that unify data, systems, and workflows. Organizations that succeed are those that enable AI to operate at the core of the business—embedded into how work gets done and innovation happens—using trusted, complete information rather than siloed, partial views.

ONEVUEX—ADVANCED TECHNOLOGY FOR THE FINANCIAL SERVICES INDUSTRY

OneVuex empowers financial institutions with a unified, intelligent platform that brings together the full breadth of Microsoft, IBM, and other technologies into a single, seamless interface. This integrated foundation enables firms to deliver more personalized, dynamic digital experiences while simplifying the execution of complex transformation strategies. With powerful AI, secure interoperability, and customizable workflows, OneVuex enhances productivity, strengthens operational resilience, and accelerates innovation—all while reducing IT maintenance and operational costs.

|

OneVuex Unified Systems is a predesigned, customizable AI platform designed to seamlessly integrate financial services applications, platforms, and data sources into a single, unified cloud platform. By unifying core financial, risk, compliance, analytics, and security systems, OneVuex eliminates data silos, operational inefficiencies, and cyber risk created by fragmented legacy infrastructures. |

The platform enables secure, real-time collaboration, streamlined operations, and data-driven decision-making across the enterprise—while ensuring regulatory compliance, auditability, data lineage, and Zero Trust security.

|

OneVuex operates at the speed and scale required to support mission‑critical financial services, from real-time risk management and fraud detection to regulatory reporting and customer experience innovation.

ONEVUEX, MICROSOFT, AND IBM—A UNIFIED AI FOUNDATION FOR FINANCIAL SERVICES

OneVuex combines Microsoft and IBM AI technologies to deliver intelligent automation, advanced analytics, and seamless integration across the financial enterprise. The platform streamlines complex workflows, automates repetitive tasks, and improves operational efficiency—while enhancing employee productivity and customer experiences.

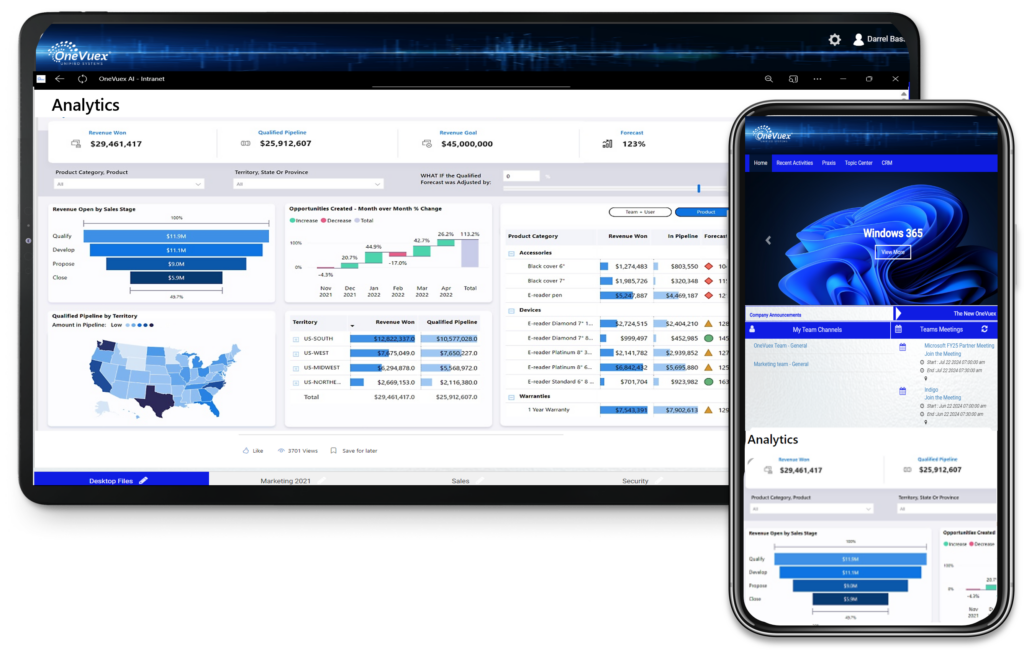

With tailored analytics and native integration with Microsoft and IBM applications—including Microsoft Dynamics for Financial Services and IBM Cognos—along with third‑party platforms, OneVuex provides real‑time data access, predictive analytics, and bidirectional CRM connectivity. Customized dashboards deliver continuous operational visibility, enabling informed decision‑making, real‑time collaboration, and more confident outcomes for financial institutions and their clients.

|

Together, these capabilities move beyond insight to execution—operationalizing intelligence across the financial enterprise. OneVuex automates repetitive financial operations such as data entry, reconciliations, reporting, case management, and customer interactions, freeing teams to focus on higher‑value, strategic work. By unifying and governing structured and unstructured data and integrating real‑time data feeds, transaction systems, and digital workflows, OneVuex provides continuous operational visibility, identifies risks and anomalies, and triggers intelligent actions—supporting proactive issue resolution, regulatory responsiveness, and improved customer experiences.

ONEVUEX – THE POWER OF GENERATIVE AI AND CODE INTEGRATION TECHNOLOGY

|

OneVuex Praxis, our Generative AI Assistant, combines OneVuex Code Integration Technology with Microsoft and IBM AI to create an advanced intelligence layer for the financial industry. Unlike conventional generative AI that relies solely on internet data, OneVuex securely integrates financial services platforms and data sources, including transaction processing, payments, risk and compliance systems, and client‑facing applications—alongside trusted external sources. Its AI cross‑checks and unifies information across all environments to deliver accurate, context‑aware results, summarize complex financial content, and provide insights that accelerate decisions while reducing operational and regulatory risk. |

ONEVUEX WITH MICROSOFT AND IBM SECURITY PROTECTS YOUR BUSINESS AT THE SPEED OF AI

|

OneVuex AI Integrated Security combines the strengths of IBM and Microsoft’s most advanced security technologies into a single, AI‑driven protection platform. It combines IBM MaaS360, Zimperium, and watsonx.governance with Microsoft 365 E5 security and compliance, Purview, Microsoft Entra, and Microsoft Security Copilot to deliver end‑to‑end Zero Trust security across identities, devices, data, applications, and cloud environments.

Designed for the financial industry’s highest security and compliance requirements, OneVuex’s proprietary Code Integration Technology embeds security and governance at the core of the platform—not as an add‑on. Every security signal, data source, application, and workload—legacy or modern—operates as part of a single, interconnected system, eliminating the blind spots and fragmentation common in traditional cybersecurity stacks.

With unified policy enforcement, automated compliance controls, Zero Trust architecture, and real‑time oversight of all AI and data interactions, OneVuex ensures that every action is governed, every access is verifiable, and every system remains protected at machine speed. . |

To explore more detailed information about OneVuex Security features, capabilities, and compliance standards, follow this link to the OneVuex Security Page.

.

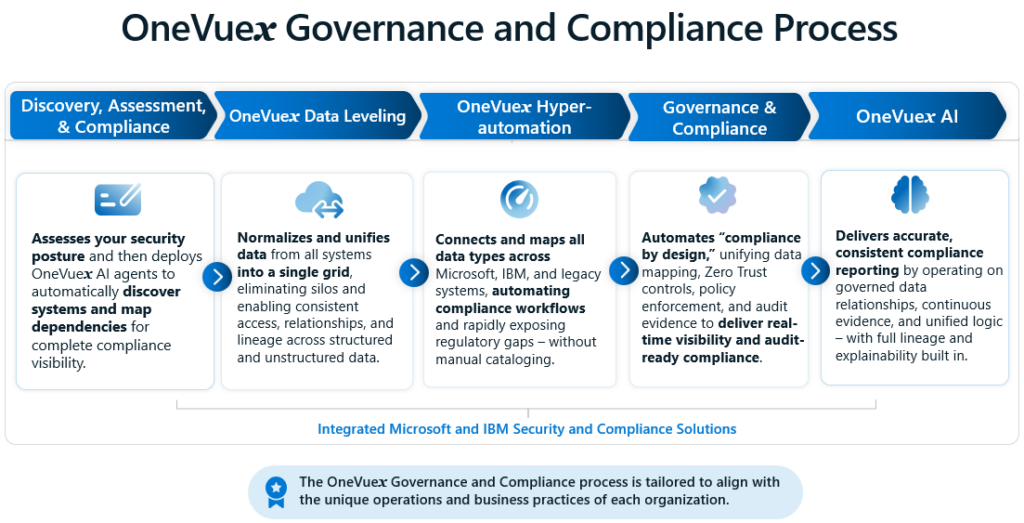

ONEVUEX GOVERNANCE AND COMPLIANCE

OneVuex unifies and operationalizes Microsoft and IBM security technologies into a single, intelligent security and compliance layer for financial institutions—spanning core banking systems, trading and risk platforms, payments infrastructure, cloud environments, data warehouses, and AI/analytics workloads. Through the OneVuex Governance and Compliance Process, every identity, device, data request, transaction workflow, and model action is continuously verified, governed, and logged across on‑premises, hybrid, and cloud environments—reinforcing Zero Trust and ensuring end‑to‑end regulatory alignment.

|

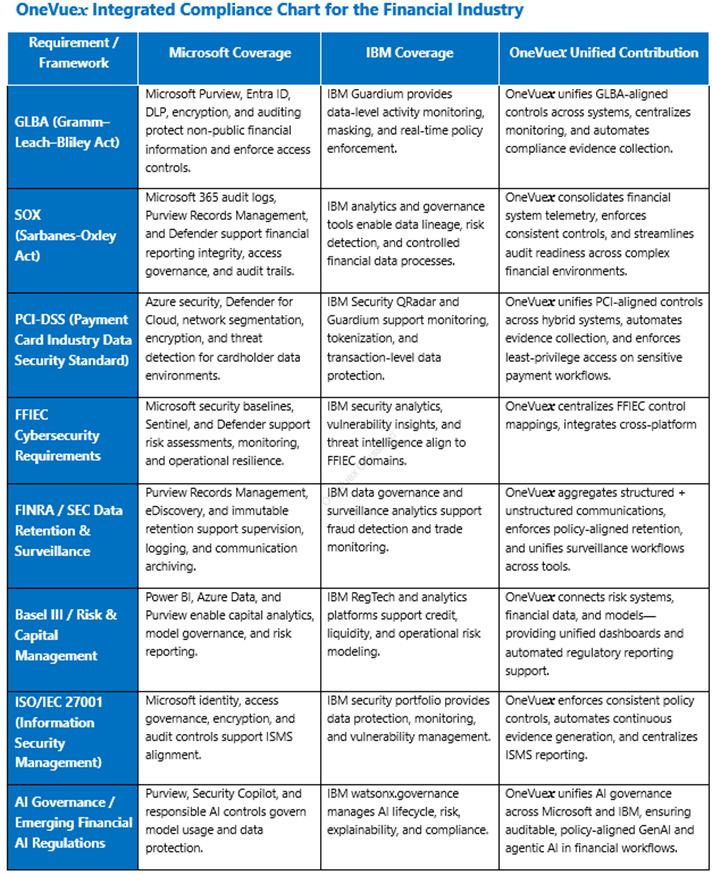

While Microsoft provides cloud identity and controls and IBM supplies deep data and AI governance controls, OneVuex unifies, operationalizes, and automates compliance across the entire financial ecosystem.

Below, is a unified view of how the three technologies jointly support U.S. regulatory requirements for the financial services industry.

|

To learn more about OneVuex Governance and Compliance for the Financial Services Industry, follow this link to our Contact Page to request the documentation.

ONEVUEX – A SINGLE PLATFORM TO MODERNIZE, SECURE, AND SCALE YOUR BUSINESS

| OneVuex delivers a comprehensive, enterprise‑grade AI and cloud platform purpose‑built for the financial services industry—unifying systems, data, workflows, and security into a single, interoperable foundation. By integrating legacy and modern environments across cloud and on‑premises systems, OneVuex enables financial institutions to operationalize AI at scale, modernize operations, strengthen security and compliance, and accelerate innovation—transforming fragmented technology landscapes into a secure, intelligent, and resilient digital enterprise. |  |

OneVuex Unified Systems – Secure by Design. Trusted Insights. Better Outcomes.

|

|